After it was found, in November 2022, that the bankrupt crypto currency exchange FTX had no financial reporting whatsoever, despite having big name investors like Black Rock, Sequoia, the Ontario Teachers Pension Fund and SoftBank, its safe to assume another round of Tech hype has come and gone – since the 2 000 era boom and bust.

Seeing what are deemed diligent venture capital investors agree to valuations as high as 32 $B for what was in essence a ponzi scheme, backed by no financial reporting, shows how far the Tech hype has gone. Its the year 2 000 all over again!

As this article from GSI Exchange reports, Tiger Global and the Ontario Teachers Pension Plan first invested in FTX in December 2019 in a funding round that valued the company at $8 billion, according to PitchBook data. Both topped up their wagers in October 2021, giving FTX a $25 billion valuation, and did so again in January, the data show. Some of the other firms and individuals backed FTX in July 2021, paying cash to participate in a $1 billion funding round that valued the crypto exchange at $18 billion

I have seen investors keep ponying up cash to keep a venture afloat after an initial stake. Never mind that it had no significant revenue, this was seen as a way to mitigate the risk of a loss. Investors that asked touch questions and doubted sky-high valuations were looked down upon. Hopefully they’ll get more respect from now on.

Is it finally time to take a more cautious look at Tech start ups for investors? To ask for revenue, versus promises ?

Teachers, Tech Hype Applies to More than Investing

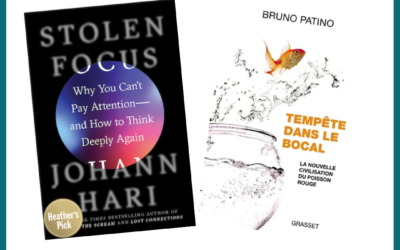

Tech hype plays at multiple levels. Its also frowned upon to criticize the way Tech disrupts our lives, in the name of Innovation – with a capital ” I”.

If it negatively impacts our privacy, our existing institutions (like news media, schools and government), that’s because its innovative. Does innovative have to equal destructive today? As we see in the FTX debacle, destruction in the name of innovation did not get anyone better off in the end. One person at least, founder and MIT graduate Sam Bankman-Fried, should even be put in jail. Smarts do not equal ethos, we are reminded.

Its disturbing to see the Ontario Teachers Pension Plan was a major investor in FTX as well. This mirrors the way schools across North America have show love to Tech, widely adopting Google and Apple products and services, in the name of Innovation.

Have students benefitted from the use of Google Classroom, Chromebooks and iPads? According to research like that of Paul Bennett’s Schoolhouse Institute, indiscriminate use of Tech in teaching and in the hands of students does not yield to better learning – despite the hype developped by big Tech companies. Guided choice and use of technology could, most likely be an addition to the learning experience. We view this approach part of critical digital litteracy or “digital citizenship” in the US.

Ontario teachers must be wondering how much of their pension is at stake with the loss from their fund’s investment in FTX.

But, while they’re not traded (yet?), I wonder how much of students’ futures is lost when they spend hours on YouTube on the school-supplied Chromebook or iPad and what’s the cost to them and us all as a society ?